In relation to safeguarding your property, acquiring the proper house insurance policies options could make a world of difference. Whether or not you're a homeowner, renter, or merely starting out, comprehension your insurance policies alternatives is important. Household insurance solutions are intended to offer economical safety in case of damage, theft, or unexpected occasions. But with lots of solutions accessible, how Did you know what fits your needs the ideal? Enable’s have a further dive into this matter and check out different aspects of property insurance plan.

At its core, household insurance policy methods are all about peace of mind. Photo this: you’ve just bought your dream dwelling, and you also’ve invested time, cash, and Electricity into which makes it your personal. But then, a pure catastrophe strikes or a mishap happens. With no right coverage, those investments can be at risk. Home insurance plan may help include The prices of repairs or replacements, guaranteeing you don't have to deal with the monetary burden by yourself.

One key consideration when Discovering house coverage remedies is the type of protection you need. There are numerous sorts of house insurance coverage insurance policies available, from fundamental guidelines that protect the framework of your own home to far more complete ideas that secure each your house and your own possessions. As an example, homeowners insurance policies normally contains coverage for your private home’s structure, individual home, liability, and extra dwelling expenditures in the event your house will become uninhabitable.

Get This Report about Insurance Claims Assistance

You will be questioning, what exactly is roofed below property insurance? Very well, property insurance policies typically addresses the four main parts: the composition of the home, particular assets, legal responsibility, and extra residing bills. With the framework, it features protection versus fireplace, storms, vandalism, along with other occasions Which may hurt your private home. Private property coverage protects your possessions, like furnishings, electronics, and clothing, in the event They are really broken or stolen. Legal responsibility coverage assists shield you if somebody is injured on your own house, and additional residing charges deal with non permanent dwelling expenses if your private home is rendered uninhabitable.

You will be questioning, what exactly is roofed below property insurance? Very well, property insurance policies typically addresses the four main parts: the composition of the home, particular assets, legal responsibility, and extra residing bills. With the framework, it features protection versus fireplace, storms, vandalism, along with other occasions Which may hurt your private home. Private property coverage protects your possessions, like furnishings, electronics, and clothing, in the event They are really broken or stolen. Legal responsibility coverage assists shield you if somebody is injured on your own house, and additional residing charges deal with non permanent dwelling expenses if your private home is rendered uninhabitable.Now, Enable’s get a better take a look at tips on how to choose the right dwelling insurance policies Option for your personal scenario. Commence by analyzing the value of your property and possessions. Do you have got important goods, like artwork or jewelry? These might have added protection, which may very well be additional towards your coverage. Next, contemplate the challenges your home faces. Will you be in a location liable to flooding or earthquakes? If that's the case, you may need to have specialized protection, given that most typical property coverage procedures Really don't address those kinds of functions.

It’s also necessary to look at your budget when buying home insurance plan. When it’s tempting to Choose The most affordable choice, quite possibly the most cost-effective insurance policy may not supply the most beneficial security. Obtaining the balance in between price and protection is vital. Search for insurance policies offering thorough protection without breaking the financial institution. A better deductible could decrease your rates, but What's more, it suggests you can expect to pay back much more outside of pocket if a declare is designed. So, look at That which you can pay for to pay upfront and pick appropriately.

Apart from the Price tag, you should also Look at the name of your insurance company you happen to be contemplating. Not all coverage suppliers are developed equivalent. You ought to select an organization which is dependable and it has a reputation of dealing with statements reasonably and proficiently. Studying on-line testimonials and examining the company’s scores with organizations like the higher Business enterprise Bureau can give you an strategy in their customer support and statements process.

Along with the coverage by itself, A different important Consider residence insurance methods would be the exclusions. Each coverage incorporates a set of exclusions—occasions that aren't coated. Common exclusions include flood and earthquake damage, as these frequently demand individual coverage. Comprehension what isn’t covered within your policy is equally as important as recognizing what is. This way, it is possible to approach for almost any further protection you might need.

Yet another typically-ignored facet of property insurance policy options is the potential for savings. Do you know that you might decrease your premiums by bundling your own home coverage with other insurance policies, like automobile insurance? Numerous vendors supply discount rates if you insure multiple Qualities or have particular safety functions in your home, like stability techniques or hearth alarms. Often ask your insurance coverage service provider about any possible bargains which will apply to you personally.

Insurance For Renters Fundamentals Explained

Enable’s not ignore renters insurance, and that is a variety of residence insurance policy Answer created for tenants. Renters coverage supplies comparable protection to homeowners insurance but applies only to your contents within your rental property. In the event you rent an apartment or dwelling, renters insurance policies can safeguard your possessions from destruction or theft. It’s an affordable option that provides relief with no cost of insuring your entire making.In regards to house insurance coverage methods, it’s not just about the fabric elements of your property. There’s also the psychological value tied to the position you simply call household. Contemplate the time and effort you've got put into your Area. If a thing had been to occur, it’s not just the monetary decline that’s concerning but additionally the memories and experiences connected to your home. Insurance plan may help restore what’s misplaced, but it’s crucial to have the proper coverage to take action correctly.

The whole process of filing a claim might be intimidating For several homeowners, Which explains why picking an insurance provider with an easy statements system is important. Just before purchasing a plan, make the effort to understand how the promises course of action operates along with your decided on supplier. Are statements handled on line, or do you must make mobile phone phone calls? Is there a focused aid staff To help you? An inconvenience-free statements course of action could make a significant big difference during stress filled times.

One more essential factor in residence insurance policies options is the extent of personalization readily available. Anyone’s desires are various, so it’s essential to work with the insurance policies supplier who will tailor a coverage to fit your distinctive situations. Irrespective of whether you’re a primary-time homeowner otherwise you’ve owned a number Risk Reduction Insurance Solutions of Attributes, acquiring a versatile and customizable policy will ensure you're adequately covered to your distinct desires.

The Facts About Insurance Portfolio Uncovered

If you live inside of a higher-possibility location, home insurance policies options may possibly include added coverage for unique threats. As an illustration, spots prone to hurricanes may have to have further windstorm protection, when properties in flood-inclined regions might have flood coverage. Constantly evaluate the risks in your neighborhood and examine them along with your insurance coverage agent to be sure your coverage addresses Those people unique desires.

An alternative choice to look at is household guarantee coverage. Although property insurance policies protects versus sudden situations like incidents or injury, dwelling guarantee insurance coverage normally addresses the expense of repairs and replacements for home programs and appliances that break down as a result of standard wear and tear. For those who have an older household with getting old appliances, this sort of insurance can assist relieve the money pressure of sudden repairs.

During the age of technological know-how, home insurance coverage solutions are becoming much more available and easier to deal with. Numerous providers give online instruments and cellular apps that permit you to handle your plan, Check this out file promises, and also observe your premiums. With these resources, it’s simpler than in the past to remain in addition to your coverage, make variations, and get help when wanted.

It's important to periodically critique your private home insurance policy policy to make certain it proceeds to satisfy your needs. As your life evolves—no matter whether it’s acquiring new things, generating household enhancements, or relocating to a unique place—your coverage must mirror These adjustments. On a regular basis reassessing your own home insurance policy will make sure you’re always sufficiently safeguarded and not paying for avoidable coverage.

Any time you’re in the marketplace for dwelling insurance policy methods, don’t hurry the method. Just take your time and effort to research distinct suppliers, Examine guidelines, and question queries. Recall, residence insurance plan will not be a a person-measurement-suits-all Resolution. The appropriate coverage Get it here for you is dependent upon your Life style, the value of your respective home, and also the hazards you face. So, take the time to decide on wisely and spend money on the coverage that’s right for you and your own home.

Mason Gamble Then & Now!

Mason Gamble Then & Now! Jennifer Love Hewitt Then & Now!

Jennifer Love Hewitt Then & Now! Michael Fishman Then & Now!

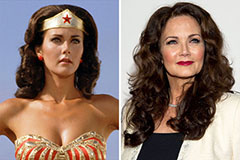

Michael Fishman Then & Now! Lynda Carter Then & Now!

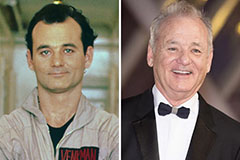

Lynda Carter Then & Now! Bill Murray Then & Now!

Bill Murray Then & Now!